Joining the national coin club and watching gold

The annual National Money Show was held in Colorado Springs, Colorado, from March 14 to 16. The show reinforced how well the coin hobby and industry are doing. It was sponsored by the nonprofit American Numismatic Association (ANA), founded in 1891 and chartered by Congress. ANA is our national coin club, based in Colorado Springs.

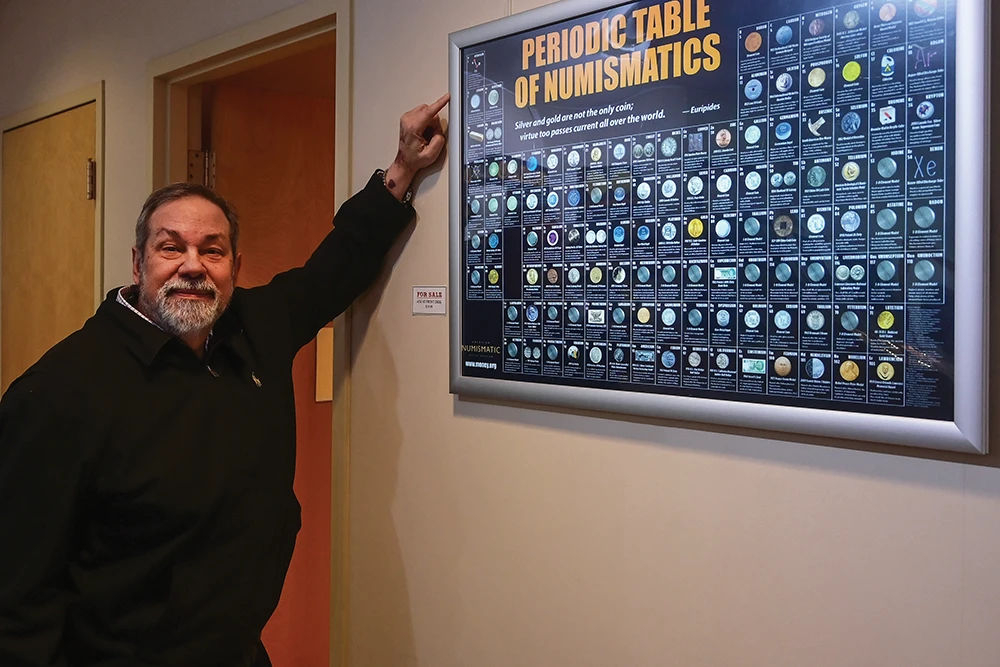

While at this year’s event, I visited some of the educational and whimsical exhibits both at the show and at ANA headquarters. I spoke with many dealers and collectors who reported they had a very good show, despite a heavy snowstorm that impacted Colorado Springs on Thursday and Friday. I go to numerous conventions each year to network with leading experts, media members and heads of organizations because it allows me to inform COINage readers about the most current information affecting the precious metals and rare-coin market.

I urge you to join the ANA (money.org), which will give you access to its library, online resources, conventions, museum and more. I have been honored to receive that organization’s highest honors: Krause Lifetime Achievement Award in 2023 and Dealer of the Year in 2021.

While attending the ANA show, I met with U.S. Mint Director Ventris Gibson and discussed Booker T. Washington, the state of the coin industry and some ideas we both had for future U.S. Mint programs. I plan to follow up with Director Gibson later this year in Washington, D.C.

Sales Tax Exemption Momentum

I serve on the executive board of the National Coin and Bullion Association (NCBA). We work to get state sales-tax exemptions on precious metal coins and bullion products. We just received word that Wisconsin is now another state that has approved sales-tax exemptions on precious-metal coins and other precious-metal products.

We are always working to help our members in many ways. After working for decades, we now have 43 states with complete or partial sales-tax exemptions on precious metal coins and other precious metal products.

Why Did Gold Soar to Over $2,260?

Before 2022, central banks had never bought more than 650 metric tons of gold in any single year, but that changed in 2022. Central banks responded to the start of the war in Ukraine in February 2022, as well as soaring inflation and weaker currency values around the world, to add a record-high 1,082 metric tons to their coffers—a huge 66% increase over the previous record.

In 2023, central banks did not quite break that record high, but they added a second straight 1,000+ ton year with 1,029 metric tons of gold buying, according to World Gold Council data. Central banks now hold an estimated 36,700 tons, or 1.18 billion troy ounces of gold, worth $2.57 trillion.

Central banks have been net buyers of gold every year since 2010, with the amount growing over the past four tumultuous post-COVID years. The World Gold Council reports the majority of purchases during the fourth quarter of 2023 came from emerging markets as they diversify from the U.S. dollar. The People’s Bank of China was the largest buyer in the fourth quarter, adding 225 tons. Poland was the second largest, buying 130 tons, followed by Singapore at 77 tons, the sole “developed” or rich nation.