PRICE RECORDS CONFIRM MARKET DEMAND

Not often does a new category of numismatics emerge out of nowhere. The beginnings of coinage in Ancient Lydia around 600 B.C., the first English penny struck under King Offa circa 785 and the first pattern coins struck for the United States in 1792 all mark the beginning of numismatic legacies that spanned hundreds and thousands of years and contributed to the corpus of what we consider coin collecting today.

In 2011, numismatics experienced a similar milestone with the production of the first physical bitcoins. The digital component of this cryptocurrency had first emerged in January 2009 but remained isolated within a small niche of enthusiasts for many years. The very infrastructure of the currency required an understanding of a variety of novel concepts such as the blockchain, digital wallets, addresses and private keys, which made wider adoption somewhat unlikely. One enthusiast, Mike Caldwell of Utah, was determined to spread awareness about this new economic system using a format that was familiar and accessible.

After experimenting with various formats, including using steel washers and car wash tokens as host coins, Caldwell developed a coin of his own design that included an embedded digital wallet that is secured by a hologram sticker. This allows for funds to be loaded onto the coin via the associated wallet, but they can only be redeemed by peeling off the sticker and accessing the private key beneath—which would render the coin void and empty.

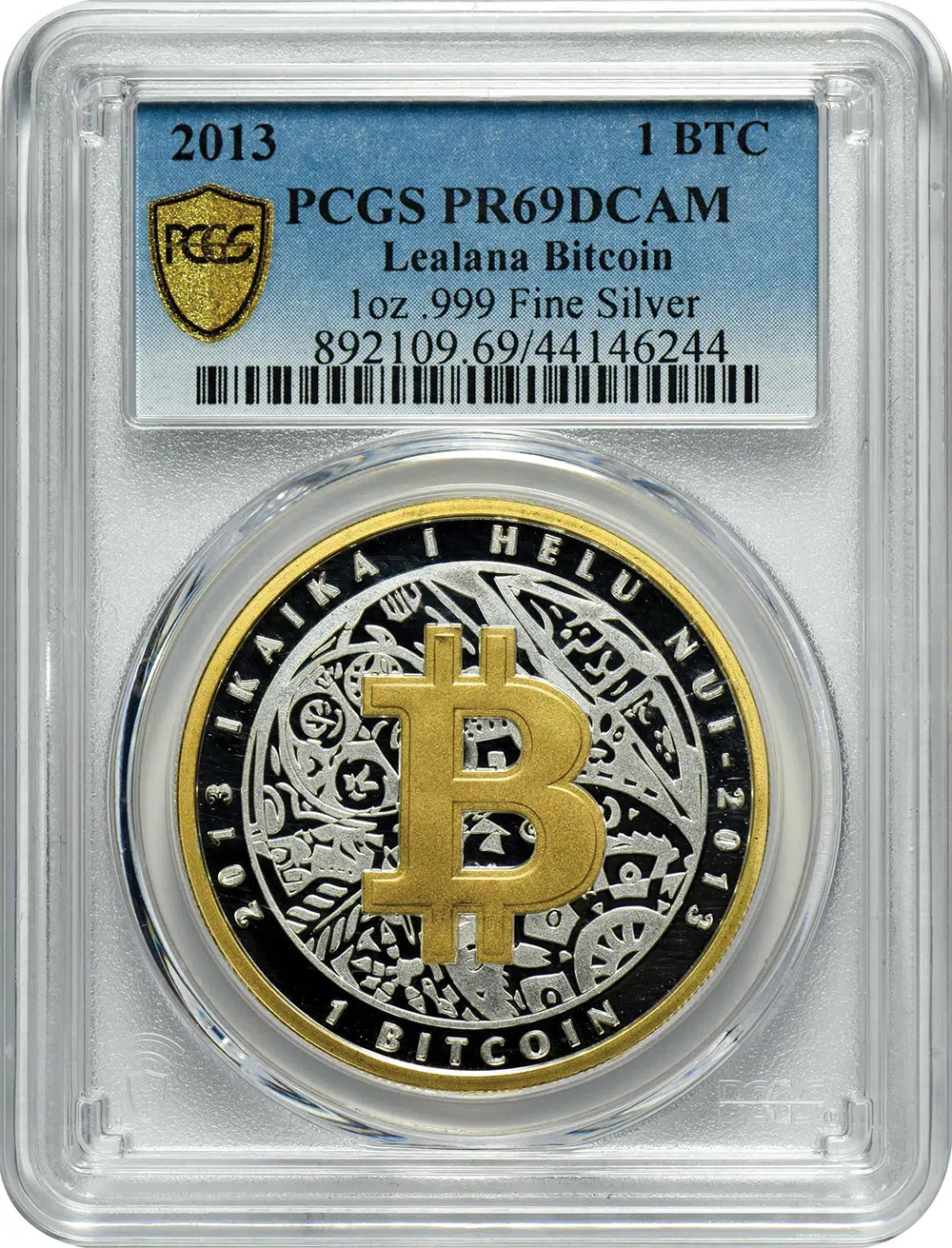

This “Casascius series” set the template for a new numismatic category that would eventually grow to include hundreds of different series. Some of the most popular include the “Lealana series” produced by Noah Luis in Hawaii and the “BTCC series” produced by famed Bitcoin entrepreneur Bobby Lee. While the designs and denominations for these coins vary greatly, the majority still employ the basic format of a private key secured beneath a security hologram that was originally established by Mike Caldwell and the Casascius series.

In concept, these new collectibles share much in common with the ever-popular category of pre-1933 U.S. gold coins of the Liberty Head, Indian Head and Saint-Gaudens series, even if the mechanics are quite different. Like the gold coins, physical bitcoins have a foundational “melt” value that is based solely on the amount of cryptocurrency loaded onto them. In addition—depending on various characteristics such as the series, denomination, variety, condition and other factors—many of these command a significant collectible premium above the melt value. Similar to how a 1927 Saint-Gaudens Double Eagle might be worth a few hundred dollars above the melt value and its 1927-D counterpart could be worth several million dollars, the small differences in physical bitcoin can make a big impact on the collectible premiums.

The first physical bitcoin to be presented in a live auction was a 2013 Lealana 0.1 Bitcoin (PCGS SP-70) offered by my firm, Stack’s Bowers Galleries, in November 2021. At the time, this coin had a “melt” value of approximately $5,400, as 1 Bitcoin was valued at around $54,000. After fierce bidding, the coin realized a total price of $33,600, defying everyone’s expectations and kick-starting a new category. In the years since, major auction firms have regularly hosted dedicated sales for this category, selling hundreds of coins per year, amounting to many millions in prices realized.

Regardless of your personal stance on Bitcoin as a digital currency, it is clear that the collectible physical format has gained an acceptance and appreciation among collectors. The current price record is held by my own firm too. It’s for a physical 1 Bitcoin (PCGS PR69 DCAM) and stands at $108,000, which represented a premium of more than 170% above the Bitcoin “melt” value at the time, in April 2022.