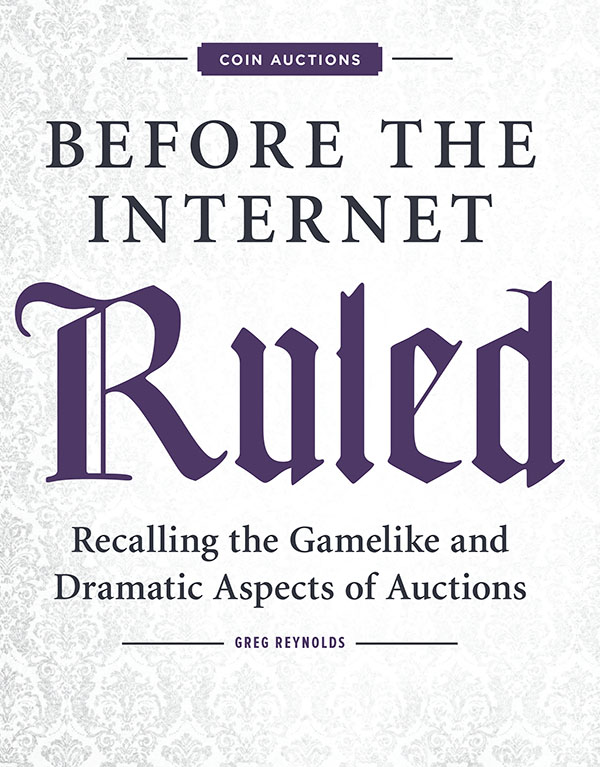

Editor’s note: This is the first in a two-part series reflecting on coin auctions prior to Internet bidding being commonplace. Enjoy Part II >>>

By Greg Reynolds

Certainly since 2015, a majority of bidders at auction for numismatic rarities have not been physically present. Most of the bidding for rarities has come over the Internet, including over the proprietary online platforms used by auction firms. Of course, I am not referring to auctions of all U.S. coins demanded by collectors.

The present topic is the nature of major coin auctions and competition for rarities before Internet bidding became a central factor. At major coin auctions and even in many minor auctions during the 1990s, the successful bidders for more than 80% of major rarities, popular condition rarities, and relatively expensive U.S. coins in general were physically present at the respective auctions.

EXPECTING THE UNEXPECTED

During the 1990s, I very much looked forward to attending major coin auctions. One reason was that each auction had an unpredictable life of its own. Turnout was sometimes surprisingly high or surprisingly low. In some cases, though, a handful of bidders pushed prices way beyond market levels. In other auctions, prices could be weak even though there were a lot of bidders in the room and market prices were rising. Auction prices were sometimes well below or well above market prices; there was just no way to tell in advance how a particular auction would unfold. Moreover, the people present were often emotional and talkative. Conversations, head-to-head competition, and the mood in the auction room affected the outcomes. There were game-like and dramatic aspects of coin auctions.

To be clear, I will here refer to major rarities, rarities that many collectors need to complete sets of U.S. coins, popular condition rarities of classic U.S. coins, and/or relatively expensive U.S. coins in general, altogether as “rarities.” While all such coins are not literally rare, it is important to keep in mind that the topic here is about bidding for particular kinds of classic U.S. coins, not for all classic U.S. coins in auctions.

The use of the Internet to buy inexpensive coins is beside the thrust of major coin auctions. Indeed, the use of the Internet to buy inexpensive coins is a separate topic. I am more knowledgeable about major coin auctions than I am about all the various venues that offer or “auction” inexpensive coins over the Internet

I have written more than 200 auction reviews, previews, and other articles relating to major coin auctions. These have appeared in eight different publications. I personally witnessed the transformation from the pre-Internet era to the present. Among the more than 100 coin auctions that I have attended in person, many are relevant to this topic of bidding for rarities before Internet bidding was a central factor.

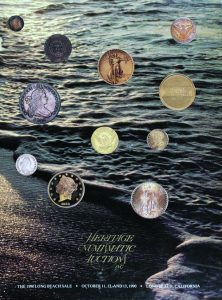

Throughout the whole decade of the 1990s, Stack’s (New York) conducted auctions where few, if any, rarities sold to Internet bidders. The famous apostrophe auctions are relevant, too. Each summer, four auction firms joined together to sell expensive U.S. coins. Unfortunately, I was able to attend only one Apostrophe Auction, the last one, Auction ’90 in Rosemont, Illinois, during August 1990. It was the big auction after March 1990 and before 1991. Millions of dollars of U.S. coins were sold. There was no Internet bidding, and some of the non-floor bidding did not lead to true sales. Almost all of the rarities that really sold in Auction ’90 went to bidders present on the auction floor.

At the official ANA auction by Bowers & Merena during the summer of 1991, near Chicago, I was amazed that there were far more than 100 people in the auction room. It was too crowded to comfortably breathe. I also remember intense bidding competition for numerous rarities in the pre-ANA sales by Superior (Goldbergs) in 1991, 1992, and 1993.

HISTORIC MOMENTS DURING LEGENDARY AUCTIONS

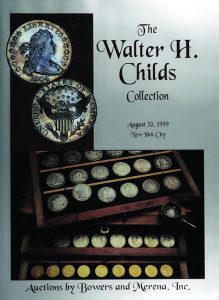

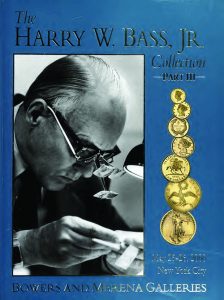

Throughout the 1990s and into the 2000s, Stack’s (New York) usually held major auctions in March and in October. Bowers & Merena (New Hampshire) conducted too many major auctions to count, a majority of which were held in New York City. The most famous Bowers & Merena (New Hampshire) auctions were the Eliasberg Collection sales in 1996 and 1997, the Harry Bass Collection sales in 1999 and 2000, and the Childs Collection sale in August 1999, which featured the finest-known 1804 dollar.

I attended the Christie’s auction of selections form the Byron Reed Collection in 1996. Byron Reed was a superstar collector during the late 19th century.

I also attended the auctions by the firm of David Akers of the U.S. coins in the John J. Pittman collection in October 1997 and May 1998. Pittman certainly had one of the 20 best U.S. coin collections of all time.

In almost all the auctions that I just mentioned, the vast majority of expensive coins included in each respective sale went to floor bidders. Yes, the Internet existed in the 1990s and played a role in disseminating information about many of these auctions. Live Internet bidding, when there was any, was not a central factor. Usually, the underbidder was physically present as well. I had met before or at least recognized most of the bidders on rarities, as rarities are defined above.

In May 2003, Stack’s (New York) auctioned the landmark Rudolph Collection of silver dollars and trade dollars. Although my notes were incomplete, I was there, and I recollect that most or almost all of the rarities went to bidders who were in the auction room. Many of the dealers who were interested in rare silver dollars were physically present. There were bidding wars.

In June 2004, DLRC auctioned the U.S. gold coins in the Richmond Collection, one of the most complete collections of all time. Again, almost all of the rarities went to people in the room, most of them to people whom I knew.

Less than a year later, at the Heritage Platinum Night event of January 12, 2005, it was still true that many of the rarities, including two Brasher Doubloons, went to floor bidders. Nevertheless, Internet bidding played a big role in that auction. Indeed, Internet bidding played a larger role in that auction than in any major auction that I had attended up until that date.

In November 2013, Heritage auctioned most of the rare U.S. silver coins from the Eric Newman Collection in New York. Collectors and dealers from all over the nation showed up to bid. While a sizable number of lots did go to Internet bidders, there was tremendous floor bidding and much electricity in the room.

Among auctions that I personally attended, the Newman sale in November 2013 was one of maybe a half dozen sales during the last decade where the atmosphere in the room caused auction prices to be much higher, in my estimation, than prices realized would have been if all bidding occurred via the Internet. Richard Burdick concurs that “the energy in the room at that Newman sale lead to unrealistically high prices.”

Richard attended major rare coin auctions from 1969 to 2016, including almost all the landmark sales along the way. Burdick declares that “the last real high-energy auction was the Missouri-Tettenhorst sale of half cents by the Goldbergs in January 2014.” Bidders attending in person “fought with each other,” and their personalities drove prices higher than they would have been if everyone had been bidding on the Internet or over the phone, in Richard’s estimation. Although I viewed in advance many of the half cents included, I am disappointed that I was unable to attend the Missouri-Tettenhorst sale.

In 2015 and 2016, Stack’s-Bowers, in association with Sotheby’s, held four auctions of the Pogue Family Collection, which was probably the all-time best collection of pre-1840 U.S. coins to be sold at auction. Many collectors and dealers showed up. A substantial percentage of the coins went to floor bidders. For some series of coins, including Capped Bust dimes, a handful of enthusiastic collectors on the auction floor battled each other for the coins.

Of the first four auctions of the Pogue Collection, prices went crazy in one, the Pogue II sale in September 2015. Although market prices had begun to fall, wild bidding brought about very strong or super-strong prices realized for many coins in the Pogue II sale. It was a very exciting auction. Although I was unable to attend the Pogue V auction in March 2017, reliable sources informed me that many large cent collectors showed up and battled each other on the auction floor to buy large cents from the Pogue Collection.