THERE’S AN INVISIBLE COIN-BUYER SPECTRUM

Coin collecting and investing are not mutually exclusive. Our beloved COINage magazine, for example, is touted as the magazine for “collectors and investors.”

The rare coin and precious metals marketplace has an invisible coin-buyer spectrum. At one end of this spectrum is the collector, who buys coins for their artistic, cultural and historical significance. At the other end is the investor, who buys coins to go to the cash window and celebrate.

Sitting between these two ends of the spectrum is the collector/investor: a hybrid combination of both. Some people are closer to being collectors than investors, and vice versa. The collector/investor understands how to get good value in the marketplace and also appreciates the beauty of coins and the artistic and cultural significance they represent. But when given an opportunity to realize a profit on a coin, a collector/investor might pause long enough to take a picture of it, but then sell it and pocket the profit.

Coin investing gets a boost

Coin investment got an enormous boost in 1974 when Congress passed legislation lifting the ban that had barred Americans from owning gold bullion for more than four decades. For the previous 40 years, only those coins whose value as collectibles exceeded their face value had been legal for Americans to own. When the ban officially ended on Dec. 31, 1974, previously prohibited gold bullion coins poured into the fertile new U.S. market and gold coins in general began to be marketed as investments on a level never seen before.

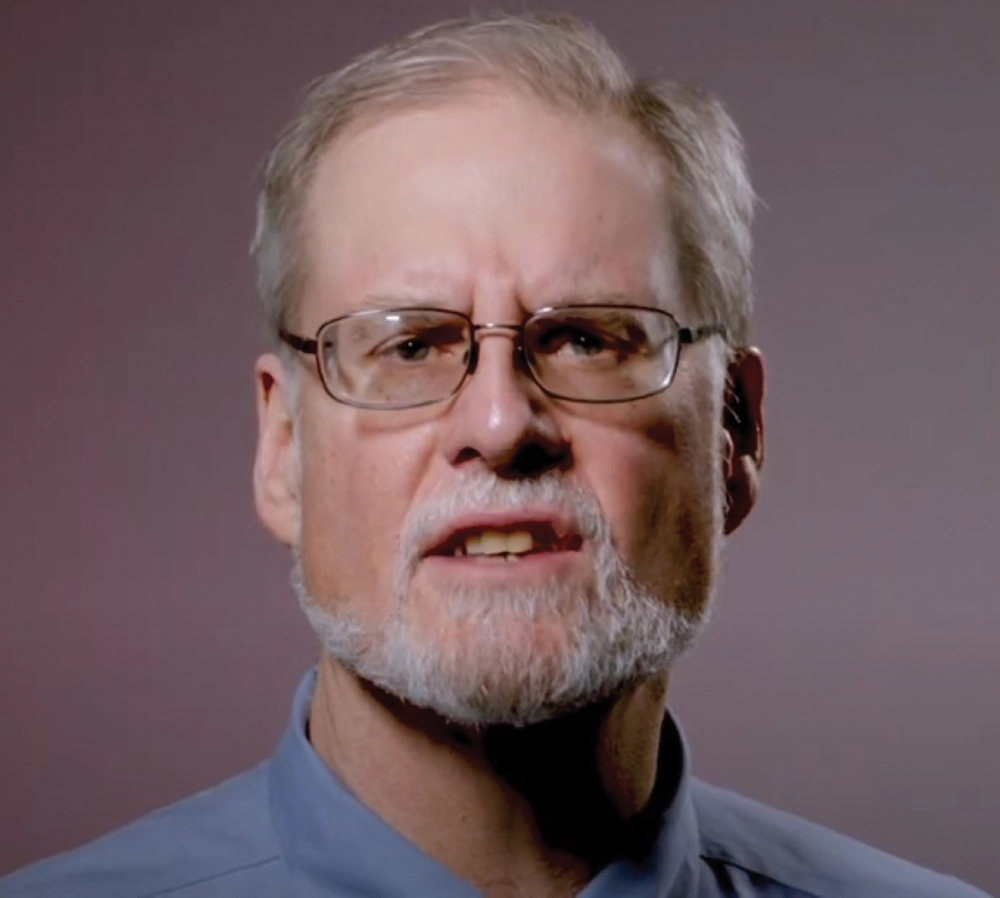

Warren Mills weighs in

“Collectors are the type of people who look to acquire coins for a certain purpose, such as completing a collection by type or date,” said Warren Mills, vice president and chief numismatist at Rare Coins of New Hampshire. “I deal with quite a lot of collectors. From firsthand knowledge, I can tell you that once [collectors] get involved in setting a goal, they’re usually not going to go away until they achieve that goal.”

Mills says that collectors generally want coins with pristine surfaces, but that investors are waiting to count their profits. “Investors want and need correct information because they often don’t know in what direction they they should be headed,” he opined. “I care about the investor meeting his or her objectives, and I care that their coins are pristine and not doctored or artificial.” he said. “I take pride in being considered a boutique dealer because I don’t have a large staff or overhead, but I have the cumulative experience of dozens of expert numismatists all within myself.”

Gold coins as a driving market force

With the return of private gold ownership, collectors and investors had two ways of acquiring the lustrous yellow metal in coinage form: the numismatic coins with which they were already familiar, and which many already owned, and the newly legal bullion coins.

The most popular and universally liquid gold bullion coin today is Uncle Sam’s American Eagle one-ounce gold bullion coin. In 2006, a new American gold bullion coin—the one-ounce, 24-karat American Buffalo—arrived on the scene and became an immediate hit, largely because it bears virtually the same design as the much-admired Buffalo nickel.

Typically, the value of a gold (or silver or platinum) bullion coin is based on the value of the metal it contains.

A numismatic gold coin is partly a bullion investment; its gold content serves as a floor for its market value. But numismatic coins command additional premiums as collector’s items and their numismatic value can be many thousands of dollars, depending on their rarity and condition and the degree of demand for them.

“I recommend that investors buy both bullion coins and rare coins,” Mills stated. “I really like the American Buffalo one-ounce gold bullion coin better than the American Eagle one-ounce gold bullion coin. The American Buffaloes are just so much rarer.”